Force Index indicator: how to play on the winner’s side

For the first time, the description of the Force Index oscillator (FRC or the Elder Index − EI) is published in the book «Trading for a Living» by Dr. Alexander Elder. For a powerful, and in the future – long-term trend, it is necessary not only to break through the current level of support/resistance, but also to provide a new direction with active deals confirming the interest of players.

It is necessary to clearly understand who is currently stronger: «bulls» that provide a price increase, or «bears», pushing the price down. The right choice of «colleagues on a trend» considerably increases chances of success.

So let’s begin.

Logic and purpose

Strong price movement begins with an increase in the volume of transactions in a certain direction – the larger the volume, the higher the probability of continuing or forming a new trend. This probability is increased by the use of moving averages in calculations. (see Compliments to the FRC indicator).

The main task of Force Index: to determine who is stronger in the market at the moment- «bulls» or «bears», so that a trader can open positions in the direction of major players. In order to determine the «victory» of the parties more accurately, the calculation of the price includes the volume.

Updating of an extremum on the line of the indicator in the direction of a price tendency confirms the current trend. If the price so far reacts poorly, but the volume rises, then this direction of movement remains a priority.

If the price updates the extremum, and the indicator does not, then any movement of a price on a small volume means that the price is moving by inertia, the current trend is weakening and it is necessary to prepare for a reversal or a market transition into a flat.

It should be understood that a strong change in prices on small volumes and small price changes on large volumes can lead to the same value of Force Index. A relative estimate of this result is important.

Calculation procedure

The difference between the current and previous prices Close, multiplied by the trading volume in the current candle, gives the so-called «raw» Force Index:

Raw Force Index (i) = Volume * (Price Close (i) – Price Close (i-1)).

Naturally, in the usual Forex trading terminal we mean a teak volume, then the indicator line turns out to be too «nervous» with a lot of rips and bursts.

If the current price of Close is higher previous («bull» market), then the result of calculation of the Force Index – positive; if below (a «bear» trend), – negative.

Value of force of the market is defined by not only the direction and amplitude of the movement but also volume.

Parameters and control

The standard setting of the Force Index, except the color scheme, assumes type selection and averaging parameter.

Standard version of the indicator

The indicator is located in an additional window under a price chart, can have a histogram appearance, but representation in the form of the line is most often used.

Standard Force Index Histogram

The author also recommended two variants of averaging, which are now considered optimal: «long» parameter (EMA 13) turns the Force Index into a trend indicator; «short» parameter (EMA 2) makes it a standard short-term oscillator.

Sometimes long periods of smoothing (more than 20) are applied; in these cases, the index can estimate a long-term trend. The period is less, the «more sensitive» the indicator turns out.

Let’s look at it in detail.

Trade signals of the indicator

The main thing in the search for signals Force Index – price changes must be confirmed by a similar dynamics of volume. If the indicator line moves near the balance line, then there is no strong trend in the market – we do not open new deals.

- Short-term Force Index(2)

Crossing the line of the zero-line indicator from the bottom to the top is considered a signal for opening purchase orders, from top to down − for sale.

The similar moments of the movement against a trend are considered as a signal for the closing of transactions.

The FRC indicator with different parameters

- Medium-term Force Index (13)

Indicator Force Index with parameter 13 (or more) shows the balance of buyers/sellers in the medium term; we argue similarly above the zero line – strong buyers, below the line – strong sellers. The further the indicator readings are from the zero mark, the stronger the current trend.

The emergence of a new extreme on the line of the indicator means that the prices are supported by trade volume in the corresponding direction. If the following max/min do not confirm a tendency, then the current trend loses volume and the speed of a price performance decreases.

The moment of the breakdown of a zero line is considered a turn signal – positions on the current trend need to be closed.

It is necessary to understand that money (or opening of new transactions) is added to the market gradually. The reaction of the indicator line Force Index in advance warns the trader of all changes in the volume dynamics, and the price is the final result of the process, therefore it reacts in the last turn.

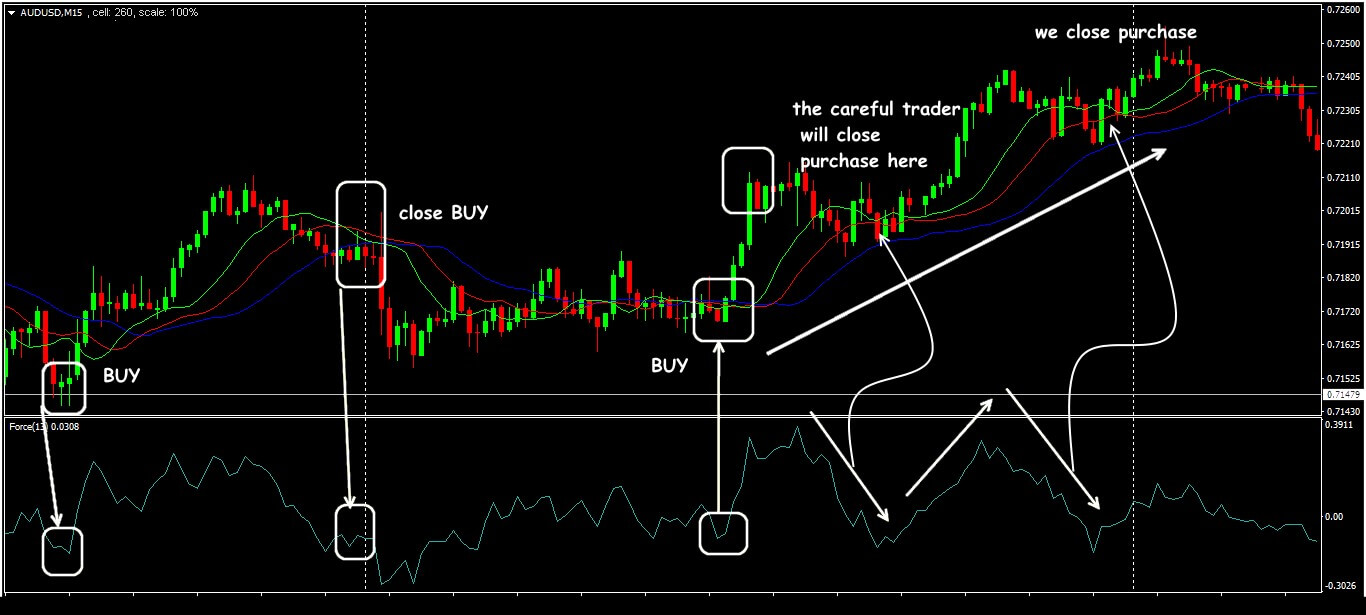

- For a long position:

It is necessary to increase the indicator from the area below the zero level; new local minimum on the Force Index line means a high probability of continuing the current uptrend. We open the transaction on rollback of the indicator down.

Scheme of signals of the FRC indicator

- For a short position:

There should be a tendency to decrease the indicator from the zone above the zero line; new local maximum on the Force Index line means a high probability of continuing a downtrend. The transaction we open on rollback of the indicator up.

- Divergence

In the event of divergence with the price schedule, that is, if the change in the market price is not confirmed by a corresponding change in volume and the indicator values do not change, it is necessary to expect a reversal of the current trend. Usually, divergence is evaluated on longer Force Index (13) (see Using Graphic Tools ).

Trade schemes divergence and breakdown of the flаt

-

- Flat on the indicator

If the indicator line fluctuates near the balance line, then the current price dynamics is not supported by the volume dynamics (increase or decrease). The following scenarios are possible:

-

- way out of a flat – if is observed weak dynamics of the price and weak dynamics of volume;

- trend turn – if high volume causes the weak change in price.

Application in trade strategy

Most often the Force Index indicator is used complete with trend tools (see Using Indicators): its signals confirm the moment of opening of a position on a trend and allow closing the transaction in a turn situation in time. (one more example of trade strategy).

Scheme of trade signals Force Index + Alligator

It is possible to construct rather stable trade strategy based on oscillators of the different type.

What this means is:

in such trade Force Index system will carry out a role of the trend indicator. (one more successful option).

Scheme of trade signals Force Index + OSMA + CCI

In the medium-term strategies, stability is ensured by tracking the trend using the method of estimating average values-for this purpose classical moving averages are used. Then the Force Index evaluates the volumes, and the standard oscillator confirms the control points.

Scheme of trade signals EMA + Force Index + Stochastic

The result?

The correct interpretation of indicator signals depends on the chosen trading methodology: short-term or long-term. Force Index (2) reacts more quickly to price changes and is used for timeframes not higher than H1, but requires more stringent capital management. Force Index (13) evaluates the probability of continuing medium-term trends and is used not only for long-term transactions, but also for monitoring short-term transactions on a trend.

Several practical remarks

Force Index signals on small periods can miss the moment of entry of the main players – their single large transactions can be invisible among the set of small warrants of other participants.

It is recommended to use the periods of not less D1 that volumes have managed to be counterbalanced.

A relative disadvantage of the indicator Force Index is the delay of signals, the problem is solved by applying additional trend indicators.

In practice, the Force Index is used as a tool for assessing the strength of the market. However, there is no information on the real amount of transactions making up the «current market volume» in the Forex terminal; the trader only sees the total number of price changes during the analysis period. Therefore, you cannot use the Force Index as the basis for creating an effective trading strategy.

Try It Yourself

After all the sides of the indicator were revealed, it is right the time for you to try either it will become your tool #1 for trading.

In order to try the indicator performance alone or in the combination with other ones, you can use Forex Tester with the historical data that comes along with the program.

Simply download Forex Tester for free. In addition, you will receive 23 years of free historical data (easily downloadable straight from the software).

Share personal experience of effective use of the indicator Force Index. This article was useful to you? It is important to us to know your opinion.

Sign Up to FTO Waitlist

Sign Up to FTO Waitlist