Do you want money? Buy gold! … or sell

Gold in any form – physical, paper, jewelry, and even virtual – has historically been considered a financial (and political!) safe-haven asset, the protection against inflation, and a guarantee of stability. Even a minimal hint of any problems is enough for investors to leave any other assets en masse, and invest in gold deals, saving their capital.

Until financiers have come up with a more stable monetary system than tied to gold, and sovereign currencies based on blockchain have not yet conquered the world, we should also join a team of successful speculators, so let’s get started.

Currency history and basic parameters

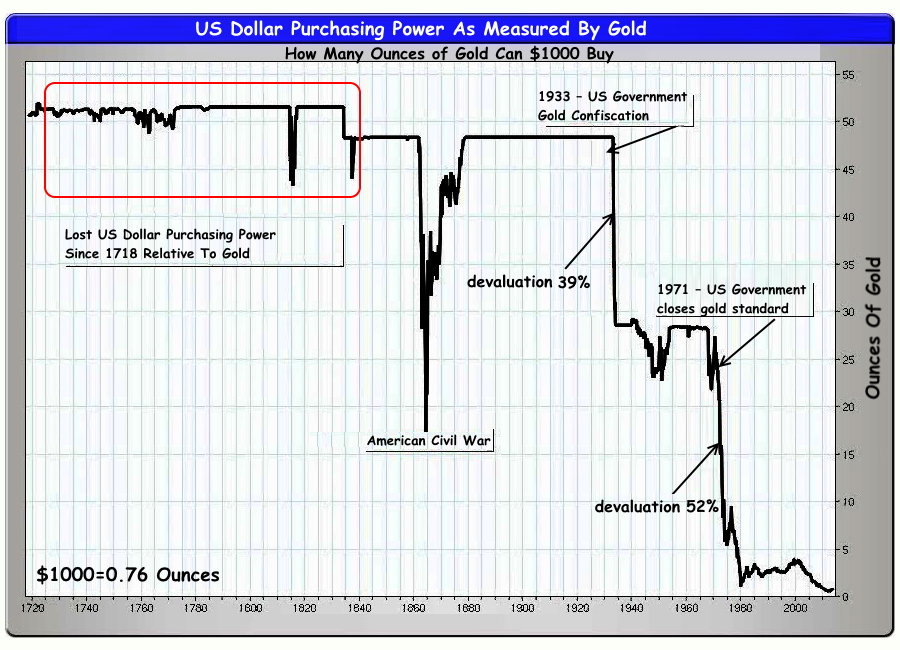

Let’s omit the ancient history of the precious metal. Before the abolition of the gold standard in 1971, the real value of any money was determined not by the face value written on banknotes, but by the weight of gold, which could be obtained in return for the “paper pulp”.

At that time, Europe was suffocating under the mass of cash dollars that it received as loans for post-war reconstruction under the “Marshall Plan”. The European business was ready to repay the United States those loans for any price as well as return trustless American money, demanding a real precious metal instead.

The consequences of the Jamaican G7 leaders meeting, at which it was decided to evaluate all currencies through the US dollar, are visible on the illustration below. Since 1978, the US Federal Reserve has sharply reduced the level of guarantee coverage of its currency with gold and continued to fill the world with an “empty” mass of dollars.

Gold and the dollar: then and now

The central banks of leading countries continue to accumulate strategic gold reserves to support and stabilize the economy.

Transactions for the manipulation of gold are usually made on the OTC market and actively influence the market rate. During periods of any financial risk, gold reserves are traded on international exchanges to increase the supply of foreign currency in the country, usually USD and EUR.

Fundamental analysis or why the volume does not go into the price

Gold assets are never traded without a preliminary assessment of the fundamental situation.

External factors that are monitored mandatory:

- dollar exchange rate – the higher it is, the cheaper the gold;

- energy prices – the more expensive, the more gold grows;

- crises, wars (including trade wars), political, economic and natural disasters;

- the macroeconomic situation in the main regions: USA, Europe, China, Japan;

- stock market dynamics.

For the market, gold is, first of all, a currency, not a commodity; therefore, the physical volume of production does not affect its speculative price.

Modern industry consumes gold in insignificant amounts. For the past 20 years, bull market fans have been actively speculating on the technological problems of the “gold” production growth. Still, in reality, the annual production volume is so small compared to the already accumulated reserves that the market does not notice it.

Sign Up to FTO Waitlist

Sign Up to FTO Waitlist