How to trade cryptocurrency and not go broke

We recall: cryptocurrency is a kind of a digital asset, based on specific methods of data protection and working on the “proof-of-work” principle, which performs the core functions of money (calculation, accumulation, investments, speculations).

Let’s not repeat ourselves, you can see the common initial information here. We assume that our readers have so solid knowledge in the cryptocurrency area that they are ready to work with them on the financial market.

The topic of cryptocurrency is multi-factor, the volume of technical and fundamental information is growing at an incredible pace. We will try to highlight only a few important problems without solving which it is impossible to enter the cryptocurrency market.

Let’s begin, but violate the ordinary scheme of storytelling and go right to the most important problem.

Risks

Cryptocurrencies use a complicated mechanism of its market price estimation, but all of them have three common risks:

- System juridical risk — there is practically no legal regulation of cryptocurrencies as a financial (exchange) instrument. In the most countries, the legal status of the crypt remains problematic, at best there are ineffective discussions held from loyal options (mining and possession are not officially restricted, but it is impossible to pay and speculate with it) up to the total ban. Actual information on this question should be followed constantly, the common information is here. So far monetary regulators have refrained from the direct control over virtual currencies and blockchain-based financial services.

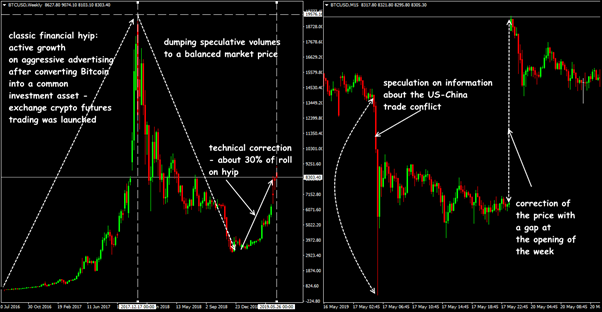

- Uncontrollable, illogical dynamics: the value (not the price!) of the same Bitcoin or Ethereum is not ensured by the State, private capital, banks or other financial structures which could affect the liquidity of the market if needed. The result? Virtual assets can completely lose their value at any moment in case if the users participating in the blockchain link lose their confidence in these assets.

- Collapse can be caused by non-market reasons, such as developers’ actions, software changes, system technical problems, fraud, hack attacks, alternate cryptocurrencies appearing on the market. It is impossible to forecast such events by the ways accustomed for a trader, and the necessity of constant diverse monitoring of the market requires time, knowledge and a lot of nerve.

Investment or speculation?

First, we need to determine why we need cryptocurrency at all.

Passive “buy and hold” strategy — tokens are purchased in the expectation of growth, they are kept either on the stock exchange account or on cold storages for some time, but changed to fiat or another asset with a currency appreciation. Short-term idea — from a week to a few months. One may invest into token at the IPO or pre-mining stage, or into a startup development after entering the market, but then on a midterm from at least 1 year.

We warn you: most crypto exchanges are regular offshore companies without any legal guarantees or segregated accounts. That’s why long-term storage of large amounts on stock accounts makes your money a perfect target for hackers and scammers.

If you are not ready to ‘freeze’ your money in such investments, you can try to act more actively.

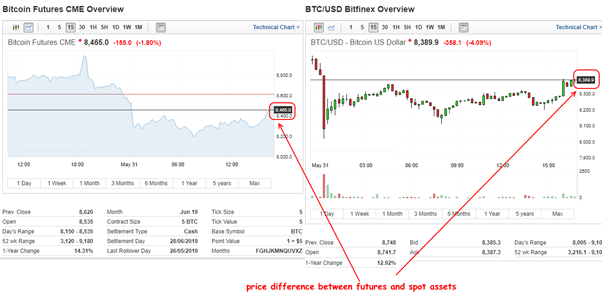

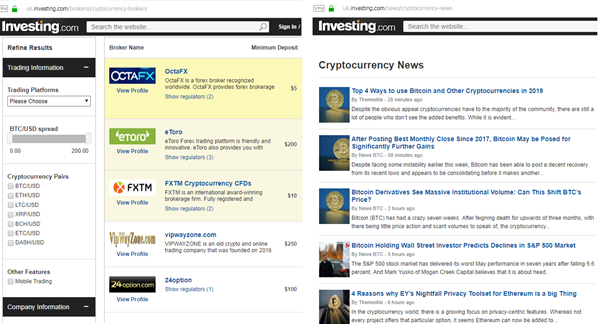

It’s possible to speculate with practically any token as a spot-asset — either directly at crypto stock markets or in exchange deals. Ordinary marginal trading — ‘buy cheaper, sell higher’. However, the entering threshold in the stock exchange may come unbearable to small clients according to the current assets and it is quite logical that brokers offer the CFD format on cryptocurrencies. The leverage size: from 1:3 to 1:100.

Usually, brokers offer accounts in a traditional fiat currency (USD, EUR, GBP, CHF), but a withdrawal/replenishment of funds are also available via virtual wallets in Bitcoin, Litecoin, Ethereum, Ripple. Keep in mind that an exchange rate from a standard into a trading cryptocurrency (especially for exoticism) can be quite a disadvantage.

Let’s look at it in detail…

Right choice of a trading asset

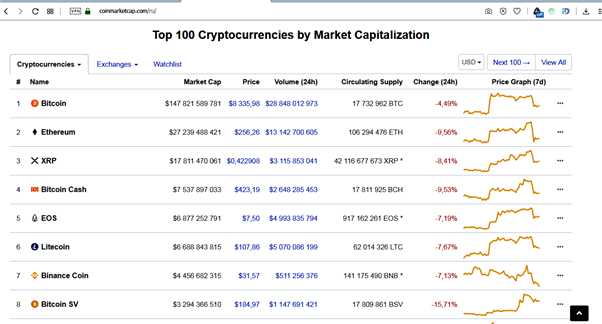

As of 01.04.2019 the system information about 1951 cryptocurrencies was known (according to some estimates — more than 2500). Most of them are considered as low liquid shitcoins (having zero value) and trading interest to them is at zero level. But there is a special group of strategies for such assets, though it’s rather of an investment than of trading, under the term penny stock. We shall not dig deep into this topic.

Regardless of what you need cryptocurrency for, choosing the active we pay attention to the following factors:

- Scope of its application.

- Financial indicators: capitalization, liquidity, trading turnover.

- The price of coin, mining possibility, coins amount at the market.

- Developers’ qualification and activism, development programme of the project.

The market leaders who hold near 75% of the global circulation, have been remaining unchanged for 5 years:

- Ethereum (ETH);

- Bitcoin (BTC);

- Ripple (XRP);

- Litecoin (LTC);

- Bitcoin Cash (BCHABC or BCHSV).

Operations with these assets are considered the most trustworthy and being actively traded on stock markets.

But! From the stock trading point of view, the “old” coins has a serious disadvantage: they all try to reach Bitcoin (with different speed). If the BTC is collapsed — no reserves, protocols or technical improvements will help, LTC, ETH, XRP, BCH will follow. Thus we recommend paying attention to some “young” coins. As of 01.05.2019 the alternate 5 of steady but more independent budget altcoins look like this:

- DASH;

- Monero (XMR);

- EOS;

- Stellar (XLM);

- TRON.

Practice shows that diversification of the risks with buying different and especially new crypto coins is ineffective, and simply dangerous to inexperienced investors. We remind: 80% of all new ICO-projects over the past 2 years proved to be failures, so we invest only into steadily working currencies which take leading positions in the capitalization rankings.

Before trading cryptocurrency, we recommend testing your strategy with ForexTester software − on real quotations of any asset and in different trade conditions.

Fundamental analysis

Decisions of the monetary regulators don’t affect the cryptocurrency directly, but studying all the available information on the chosen crypto asset is necessary. We recommend www.Coinmarketcap.com and https://www.cryptocompare.com — perfect aggregators of the information on practically all tokens available for trading/exchanging.

Technical analysis

The most important factor of crypto assets analysis is estimation of the capitalization volumes, you need permanent access to the actual data at least on free resources.

There is no full-fledged (from the Forex point of view) liquidity on cryptocurrencies, currency pairs from the popular token (BTC, LTC, XRP, ETH) and ordinary currencies (USD, EUR, CNH) are considered the most stable ones — they are well projected with traditional methods through high “technicality” of the fiat assets (see Using Indicators)

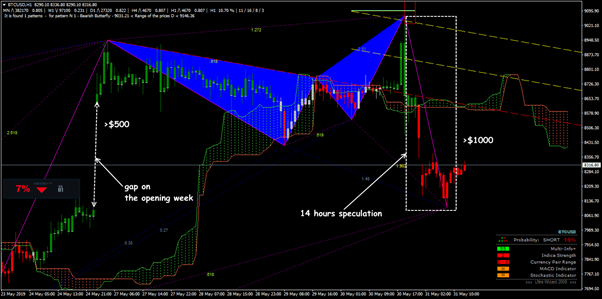

Technical analysis for cryptocurrencies causes reasonable mistrust since the volatility on these assets is hundreds times higher than at the stock market or currencies. Gaps on cryptocurrencies are noticed far more often, because of what the submissions fulfilment time can be too high. Right away crypto brokers discuss the right for forced deals closing, volume restrictions, super-high spread and other disadvantageous for trader terms. However, classic instruments can be used during relatively calm movement (see Using Graphic Tools).

There are no special super-strategies for cryptocurrencies, at least for Bitcoin. Standard technical analysis works from H! and lower, necessarily with Stop Loss and strict mini management, let’s not forget about the spread and overall expenses for conversion. Tick volume on the crypt loses its sense at all, and real stock volumes are hard to estimate because the decentralisation of crypto stock markets is much stronger than the one of Forex. The volume of hidden submissions on BTC and ETH are dozens times higher of the “invisible” volume, so it’s worth to operate with the short-term analysis only.

What is allowed:

- technical scalping not lower of M15, not linked to volumes;

- indicator, graphic and VSA strategies: trend, breakthrough;

- arbitrage (spatial and static);

- pump (provocation of the market participants in the way of creating large deals) and damp (abrupt fall of the course, caused by the specific volume “drop” by major participants);

- news trading.

Useful online resources

Most popular crypto funds:

- BlockchainCapital; Cryptobazar; Crypto20; DraperAssociates; Digital Currency Group; TaaS; AlphabitFund; BlockTower Capital; Crypto Asset Fund; Auryn Capital; Pantera Capital.

It is necessary to track the rating of cryptocurrency exchanges in terms of trading volume, for example, here Top 100 Cryptocurrency Exchanges by Trade Volume. Current exchanges for arbitration Binance; CEX.IO; EXMO; Bittrex; Bitfinex; Kraken; Poloniex; Huobi; ItBit; GDAX; HitBTC; Cryptopia; BTC Trade;OKcoin; YoBit; Coinbase Pro; OKEx.

Services for comparing prices on exchanges: Bitinfocharts, Bitcoinity, Coinmarketcap; Bittrex/Yobit Exchange Tool, Apitrade.pro, Cryptowat.

News on cryptocurrencies can be read here:

- www.Coinmarketcap.com; www.Coindesk.com; www.Coinjournal.net; www.Btcmanager.com; https://pro-blockchain.com/en; https://Bitcointalk.org; https://forklog.media; https://uk.investing.com/crypto/;

- https://cryptohackers.party/; https://news.Bitcoin.com/; http://www.cryptocoinsnews.com/; https://99Bitcoins.com/;

- https://Bitcoinmagazine.com;

- http://www.Bitcoinx.com/news/; https://coinbuzz.stream/; https://cryptodiffer.com/.

Several practical remarks

Pay attention to the submission fulfilment speed: with such a volatility any of them can be fatal for the deposit.

Far not every token has a solid perspective for existence, and especially — profitability. Today it’s enough just to “create” a crypto coin, skim the cream on the hype and disappear at any moment. What this means is that one can’t seriously invest into “new” currencies with uncertain history (unless this is your personal startup!).

Don’t give in to advertisement: by ordinary trading even experienced players can earn 100-150% per month at best on a cryptocurrency, and newcomers rarely rise more than 15% with an extremely high risk of fast losses. That’s why it is mandatory that we regularly withdraw a part of crypto profit from the trades and monetize it into fiat currencies or other assets.

Try It Yourself

As you can see, backtesting is quite simple activity in case if you have the right backtesting tools.

The testing of this feature was arranged in Forex Tester with the historical data that comes along with the program.

To check this (or any other) feature’s performance you can download Forex Tester for free.

In addition, you will receive 23 years of free historical data (easily downloadable straight from the software).

Sign Up to FTO Waitlist

Sign Up to FTO Waitlist